As the financial year comes to a close, taxpayers are busy reviewing their investment declarations, computing tax liabilities, and ensuring that all compliances are in order. Overlooked yet critical area for property buyers is TDS (Tax Deducted at Source) compliance under Section 194-IA of the Income Tax Act.

If you’ve purchased immovable property (other than agricultural land) valued above ₹50 lakhs during the year, you are legally required to deduct TDS at the time of making payments to the seller. This article offers a year-end compliance checklist to help buyers fulfill all necessary obligations before March 31st.

📌 Understanding TDS on Property Purchase

Section 194-IA mandates that a buyer must deduct 1% TDS from the sale consideration if the transaction value exceeds ₹50 lakhs. This is applicable even if the payment is made in installments. TDS deposited with the government and reported using Form 26QB. Buyers required to issue a Form 16B (TDS certificate) to the seller.

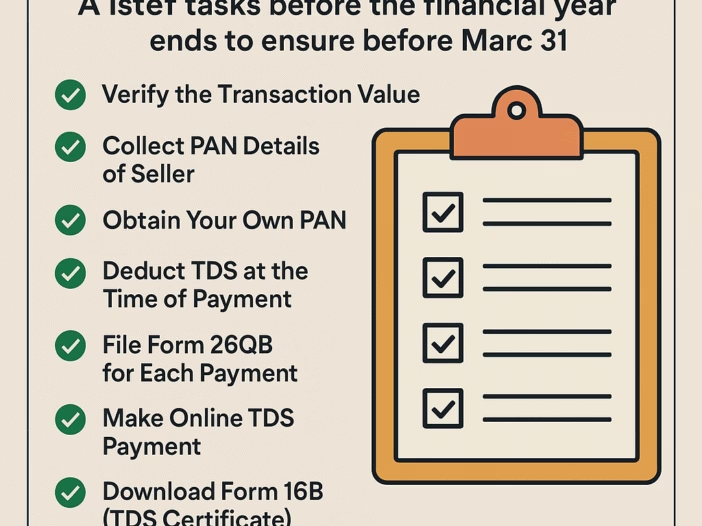

✅ Year-End Compliance Checklist for Property Buyers

Here’s a practical list of tasks you should complete before the financial year ends to avoid late fees, interest, or legal notices:

1. Verify the Transaction Value

- Check if the total property value (including extra charges) crosses ₹50 lakhs.

- If yes, TDS under Section 194-IA is mandatory.

- Remember: TDS is on entire value, not just the amount above ₹50 lakhs.

2. Check PAN Details of Buyer and Seller

- Ensure both your and the seller’s PANs are valid and correct.

- If the seller does not provide a PAN, you cannot process Form 26QB, and it may lead to higher TDS liability or rejection.

3. Deduct TDS at Each Payment Stage

- Deduct 1% TDS you make payment, not just the time of registration.

- Even advance payments before agreement are liable for TDS.

Example: If you paid ₹10 lakhs in January and ₹40 lakhs in March, you must deduct ₹10,000 and ₹40,000 respectively.

4. Deposit TDS via Form 26QB

- Use TIN-NSDL portal to file Form 26QB.

- Form filed within 30 days from end of the month which payment is made.

- For each buyer-seller combination, a separate 26QB form is required.

5. Pay TDS Online

- Payment should be made using net banking, debit card, or authorized bank branches.

- Keep the payment receipt or challan as a record for future reference and ITR filing.

6. Download Form 16B (TDS Certificate)

- After filing Form 26QB, login the TRACES portal download Form 16B.

- Provide certificate to the seller within 15 days of TDS filing.

7. Ensure TDS Appears in Seller’s Form 26AS

- Ask the seller to verify that the TDS is reflected in their Form 26AS.

- Any mismatch may create issues during their income tax return filing.

- This ensures transparency and maintains goodwill.

8. Correct Errors, If Any

If there’s a mistake in:

- PAN

- Amount

- Assessment year

- Payment details

You should file a correction request on TRACES immediately. Do this before the financial year ends, as delays can result in penalties or TDS mismatch in your or the seller’s tax profile.

9. In Case of Joint Buyers or Sellers

- TDS must be proportionately deducted by each buyer, based on their share.

- Each buyer must file a separate Form 26QB for each seller.

Example:

If there are 2 buyers and 2 sellers, you’ll need to file 4 Forms 26QB per payment installment.

10. Match All TDS Entries With Your Records

- TDS challan Form 26QB acknowledgements and Form 16B certificates your property documents.

- Store copies of all TDS documents along with the Sale Agreement and Payment Receipts for audit or income tax purposes.

11. Review Bank Statements & Deadlines

- Go through your bank statements to check for any missed payments where TDS wasn’t deducted.

- Ensure all TDS deposits are made before March 31st to include them in the current year’s Form 26AS.

12. Late Deduction or Non-Compliance? Rectify It Now

If you’ve missed deducting TDS on earlier payments:

- Deduct and pay immediately with interest.

- File Form 26QB with correct dates.

- Avoid further delay as interest @1% per month on delay in deduction and 5% on delay in deposit applies.

💡 Benefits of Timely Compliance

- No penalty or late fees from Income Tax Department.

- Avoid notices for non-compliance.

- Ensures smooth ITR filing for both buyer and seller.

- Maintains a clean tax record and avoids scrutiny.

📋 Summary Table: TDS Compliance Timeline

| Task | Timeline | Platform |

| Deduct TDS | At each payment | Offline/Agreement |

| File Form 26QB | Within 30 days | TIN-NSDL |

| Pay TDS | Along with Form 26QB | Online Banking |

| Download Form 16B | After 26QB filing | TRACES |

| Provide Form 16B to Seller | Within 15 days | Email/Hard copy |

| Correct Errors (if any) | Before March 31st | TRACES Portal |

🏁 Conclusion

TDS compliance is not merely a post-transaction task—it is a continuous responsibility throughout the purchase process. As the financial year ends, make sure your TDS duties are up to date. This simple checklist can protect you from penalties, maintain transparency with the seller, and ensure your transaction is in full compliance with income tax law.

By completing these steps before March 31st, you can move into the next financial year with peace of mind.