When purchasing a property, understanding your tax obligations is as important as choosing the right location or builder. One key obligation under Indian tax law is the deduction of Tax Deducted at Source (TDS). Under Section 194-IA of the Income Tax Act, 1961, buyers of immovable property (excluding agricultural land) are required to deduct TDS if the value exceeds ₹50 lakhs. However, the nature and timing of TDS deductions can vary depending on whether the property is under-construction or ready-to-move-in.

This article explores the differences in TDS obligations when buying under-construction vs. ready-to-move-in properties, and helps buyers make informed decisions with full tax compliance.

Understanding the Legal Framework

Section 194-IA – Basics:

- Applicable when a buyer purchases an immovable property (land/building/flat) worth ₹50 lakhs or more.

- TDS rate: 1% of the consideration.

- TDS must be deducted and paid using Form 26QB within 30 days from the end of the month in which payment is made.

- The buyer must furnish Form 16B (TDS certificate) to the seller.

Under-Construction Properties: TDS Implications

1. When Is TDS Deducted?

In the case of under-construction properties, TDS is deducted at the time of each installment/payment, not just at the time of agreement or possession. Since payments are usually staggered over construction phases, TDS compliance must be done multiple times, corresponding to each installment.

2. How TDS Is Calculated?

TDS is calculated at each installment, provided the total agreement value exceeds ₹50 lakhs.

Example:

- Agreement value: ₹60 lakhs

- Payment schedule: 6 installments of ₹10 lakhs

- TDS to be deducted: ₹10,000 per installment (1% of ₹10 lakhs)

3. GST Implication:

Under-construction properties attract GST at 5% (without ITC) or 1% for affordable housing, which is not applicable for ready-to-move-in properties. However, TDS is deducted on the gross amount including GST, as clarified by CBDT Circular No. 23/2017.

Ready-to-Move-In Properties: TDS Implications

1. One-Time TDS Deduction:

In ready-to-move-in properties, the entire amount is usually paid in a lump sum or in a couple of installments at or after possession. Therefore, TDS is deducted at the time of making full payment, often in one go.

Example:

- Sale price: ₹75 lakhs

- Full payment made at registration: ₹75 lakhs

- TDS to be deducted: ₹75,000

2. No GST:

GST is not applicable on the sale of ready-to-move-in properties if the Completion Certificate (CC) has been issued. This simplifies the calculation as TDS is deducted on the total consideration without GST confusion.

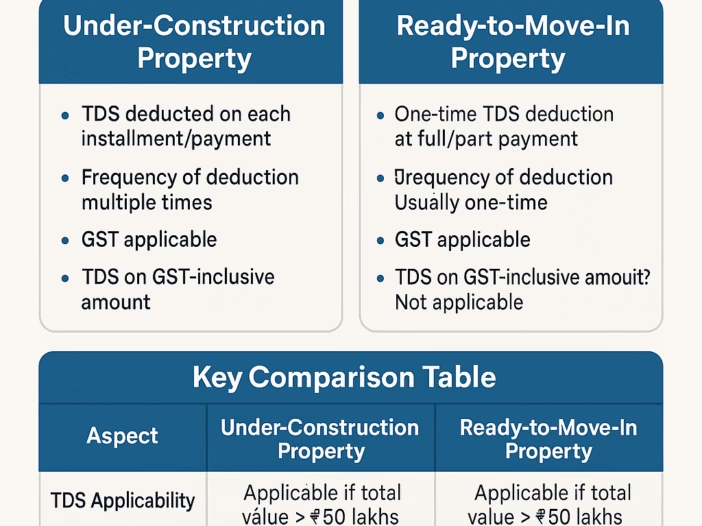

Key Comparison Table |

||||||||||||||||||||||||

|

Common Mistakes and How to Avoid Them

1. Incorrect Deduction Amount:

Some buyers deduct TDS excluding GST for under-construction properties. This is incorrect. TDS should be deducted on the total invoice amount including GST.

Tip: Confirm invoice breakup and ensure compliance with CBDT guidelines.

2. Missing TDS for Initial Payments:

Buyers often forget to deduct TDS for initial booking amounts or payments made before formal agreement.

Tip: TDS must be deducted on every payment once the ₹50 lakh threshold is crossed.

3. Late Payment of TDS:

TDS must be deposited with the government within 30 days from the end of the month in which payment is made. Delay attracts interest and penalty.

Tip: Mark your calendar or use auto-reminders for each installment.

4. TDS Not Deducted on Joint Property Purchase:

In cases of joint buyers, TDS obligation still applies if total value exceeds ₹50 lakhs, even if individual share is below that.

Tip: Deduct proportionate TDS as per ownership and file separate Form 26QB for each buyer-seller pair.

Documentation and Proof

Buyer Must:

- Deduct 1% TDS

- Deposit it online via Form 26QB (https://tin.tin.nsdl.com)

- Issue Form 16B to seller (download from TRACES)

Seller Must:

- Include TDS details in income tax return

- Match TDS deducted in Form 26AS

Tax Planning Considerations

If you’re choosing between under-construction and ready-to-move-in property, beyond TDS, also factor:

- GST Burden: Adds up in under-construction.

- Possession Timeframe: May delay in under-construction.

- Financing: Banks often deduct EMI during construction without possession.

- Compliance Load: More at under-construction due to multiple TDS filings.

From a compliance and cost-efficiency perspective, ready-to-move-in properties generally involve less paperwork, no GST, and simpler TDS deductions, making them preferable for buyers looking to avoid complex TDS procedures.

Conclusion

While TDS deduction is mandatory for both under-construction and ready-to-move-in properties over ₹50 lakhs, the timing, calculation, and compliance process differs significantly. Under-construction properties require careful tracking of each payment and multiple TDS filings, while ready-to-move-in options are relatively straightforward.

Buyers must ensure they:

- Understand their obligations under Section 194-IA,

- Deduct TDS on the correct amount (including GST where applicable),

- File Form 26QB timely for each payment,

- Provide the seller with Form 16B.

Ensuring timely and correct deduction of TDS will protect you from penalties and help maintain compliance with the Income Tax Department.