The Union Budget 2025, unveiled by the Finance Minister, introduced several policy measures aimed at streamlining the tax regime, improving transparency, and promoting compliance. One area that drew notable attention was the real estate sector, especially regarding Tax Deducted at Source (TDS) under Section 194-IA of the Income Tax Act. These changes are significant for […]

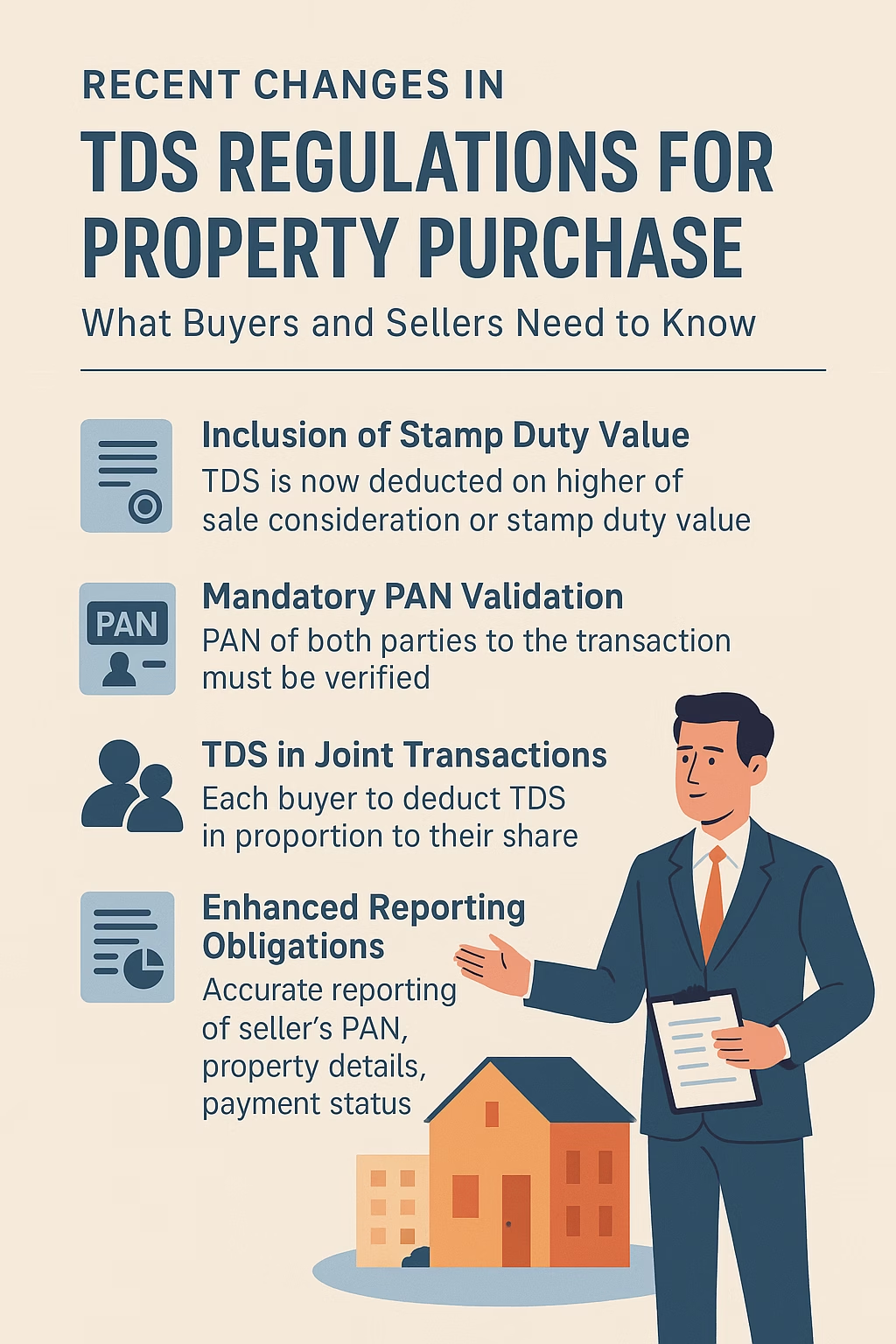

Recent Changes In TDS Regulations for Property Purchase

Buying or selling immovable property is a significant financial transaction and, in India, it also carries specific tax obligations. One of the most critical components of this transaction is the Tax Deducted at Source (TDS) under Section 194-IA of the Income Tax Act, 1961. Over the years, the government has introduced various amendments and notifications […]

TDS On Property Purchase

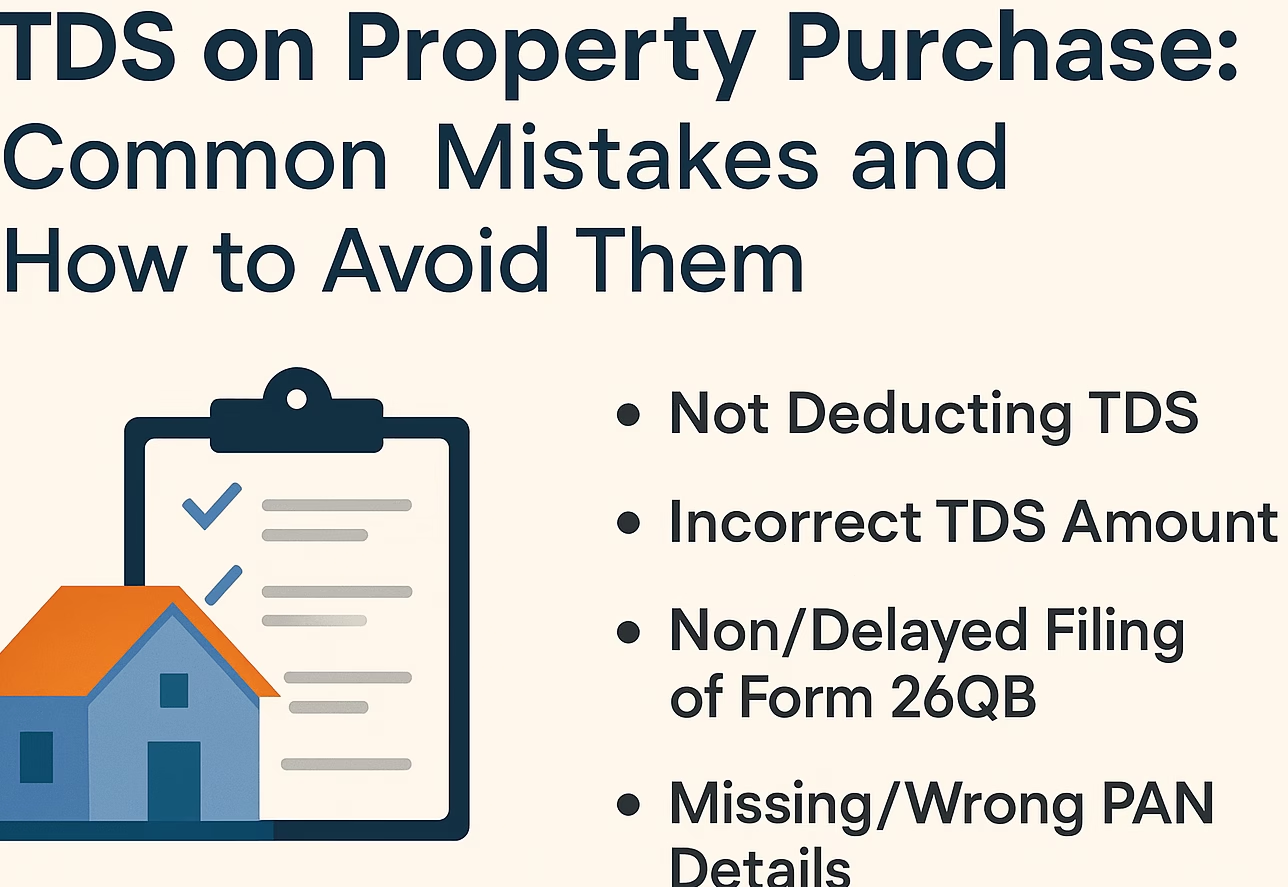

As the financial year comes to a close, taxpayers are busy reviewing their investment declarations, computing tax liabilities, and ensuring that all compliances are in order. Overlooked yet critical area for property buyers is TDS (Tax Deducted at Source) compliance under Section 194-IA of the Income Tax Act. If you’ve purchased immovable property (other than […]

Understanding The Importance Of PAN In TDS On Property Deals:

Emphasizing the Role of PAN for Both Buyers and Sellers in TDS Compliance Property transactions in India often involve a significant amount of money, and to prevent tax evasion, the Income Tax Department has mandated Tax Deducted at Source (TDS) on such deals under Section 194-IA of the Income Tax Act. The most critical components […]

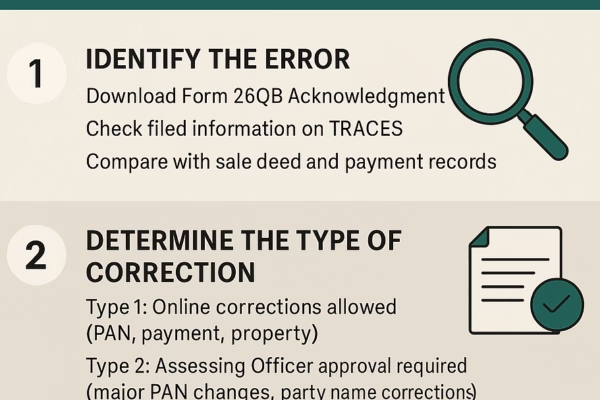

Common Errors In Form 26QB Filing

Buying a property is a significant financial decision, and with it comes several legal and tax-related responsibilities. One such obligation is the deduction and payment of TDS (Tax Deducted at Source) under Section 194-IA of the Income Tax Act, applicable when property is purchased for ₹50 lakhs or more. The buyer required to deduct 1% […]