Tax Deducted at Source (TDS) on property transactions is a critical compliance requirement under the Indian Income Tax Act. With the growing focus on transparency and curbing black money in the real estate sector, the Income Tax Department mandates that buyers of immovable properties (other than agricultural land) deduct TDS at the time of purchase […]

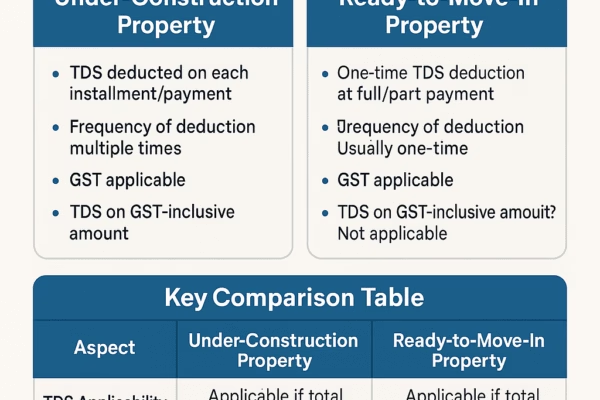

TDS On Under-Construction vs. Ready-To-Move-In Properties:

When purchasing a property, understanding your tax obligations is as important as choosing the right location or builder. One key obligation under Indian tax law is the deduction of Tax Deducted at Source (TDS). Under Section 194-IA of the Income Tax Act, 1961, buyers of immovable property (excluding agricultural land) are required to deduct TDS […]

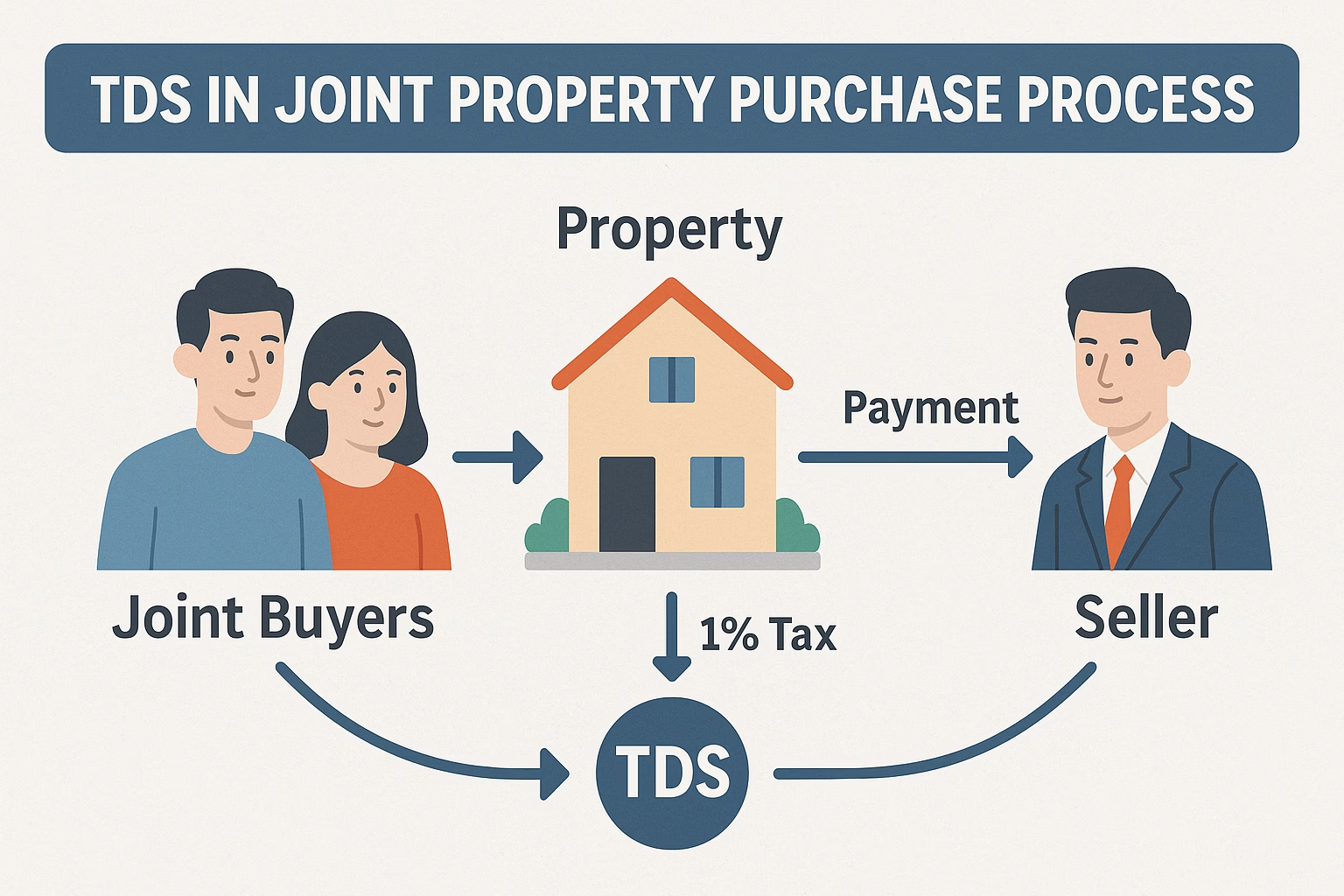

TDS In Joint Property Purchase

Purchasing property in India is a major financial decision, and when multiple buyers or sellers are involved, the complexity increases—especially when it comes to Tax Deducted at Source (TDS). Under Section 194-IA of the Income Tax Act, 1961, buyers are required to deduct TDS on the sale of immovable property (other than agricultural land) if […]

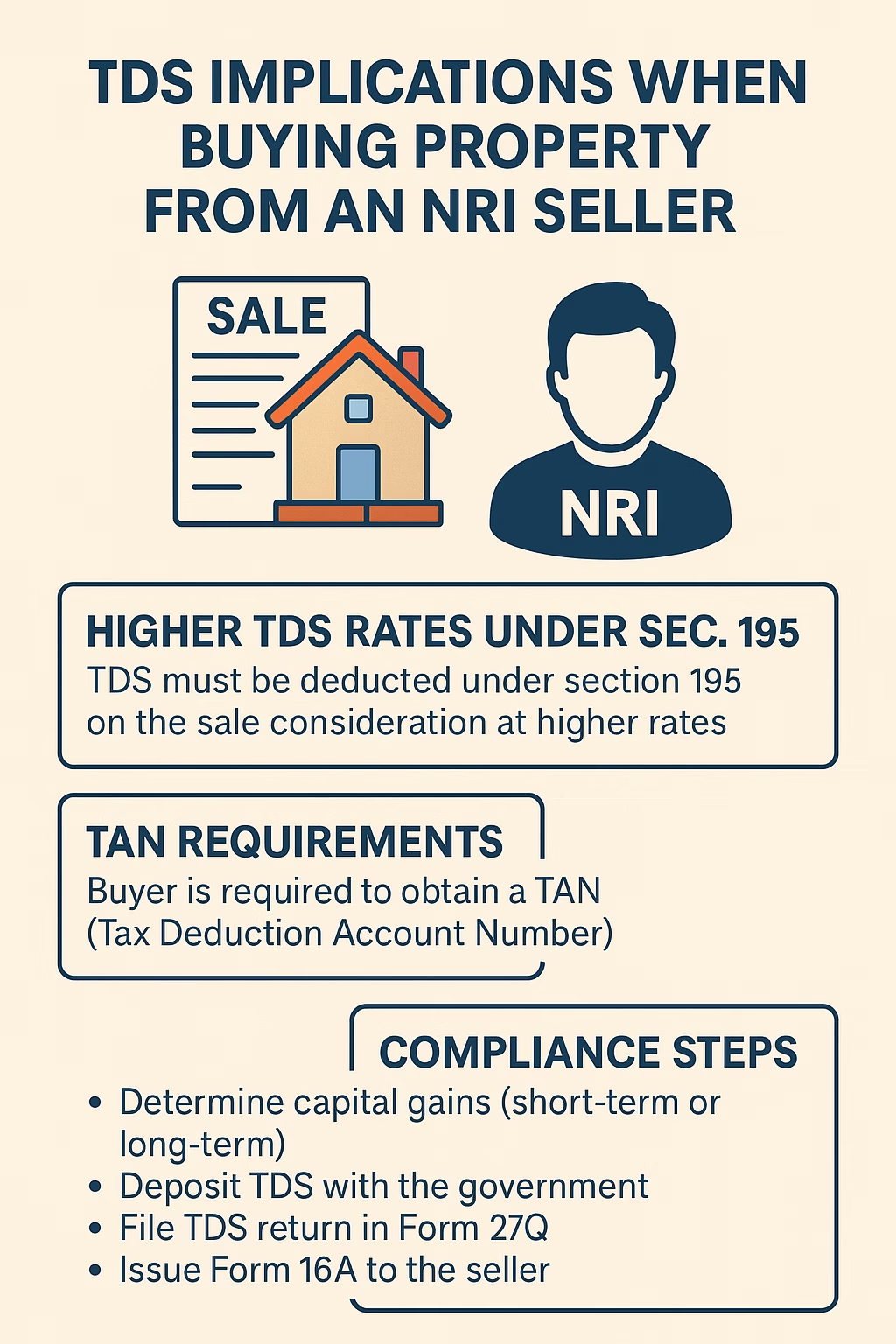

TDS Implications When Buying Property from an NRI Seller

(Understanding Section 195, Higher TDS Rates, TAN Requirements & Compliance Steps) Buying property in India is a significant financial decision, and when the seller is a Non-Resident Indian (NRI), the transaction becomes even more complex from a tax compliance perspective. One of the most crucial aspects in such a scenario is Tax Deducted at Source […]

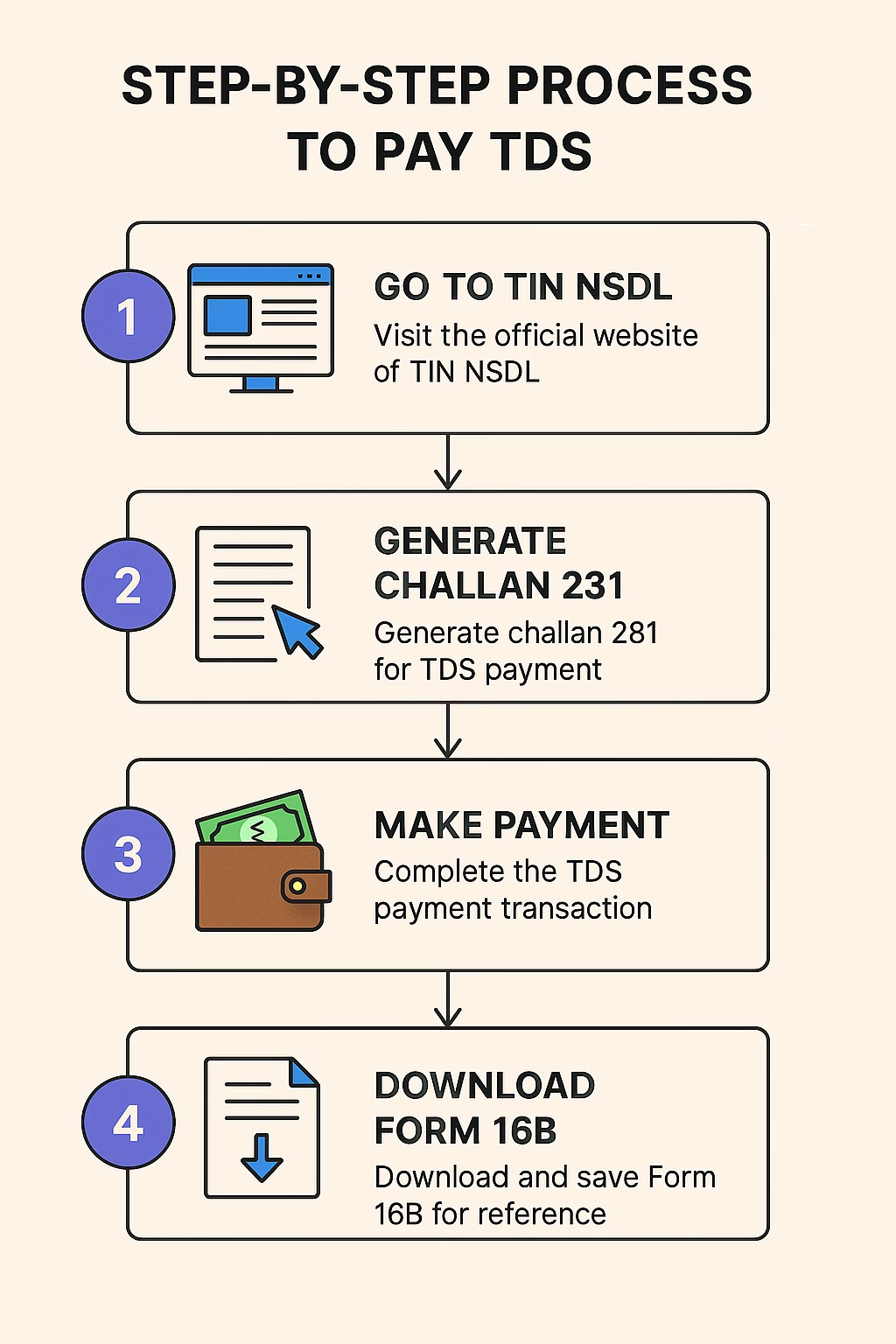

Process To Pay TDS By Using Form “26QB”

Purchasing a property is a significant milestone and a financially important transaction. One of the legal responsibilities you bear as a property buyer in India is to deduct and deposit Tax Deducted at Source (TDS) under Section 194-IA of the Income Tax Act. This requirement are applies whe006E property value exceeds Rs50 lakhs. In this […]