Capital gains tax is one of the most significant taxes levied on individuals and entities when a property is sold for a profit. In India, income from sale a residential or commercial property falls under the ‘Capital Gains’ head in Income Tax. In this article are define as capital gain on sale of property. What […]

Section 194N TDS On Cash Withdrawal from Bank

Section 194N of the Income Tax Act, 1961 is effective from 1st September 2019. This section was brought into force to discourage cash transactions and promote digital economy by levying Tax Deducted at Source (TDS) on cash Withdrawal from Bank above a certain limit. In this article, we’ll discuss the complete procedure, threshold limits, TDS […]

PPF Withdrawal – Complete Procedure

The Public Provident Fund (PPF) is one of India’s most popular long-term savings-cum-investment instruments; it provides tax-free returns and acts as a safe vehicle for wealth accumulation and retirement planning. You have to repay it with a small interest, and it helps avoid taking outside loans. PPF paying for company for employers are every month […]

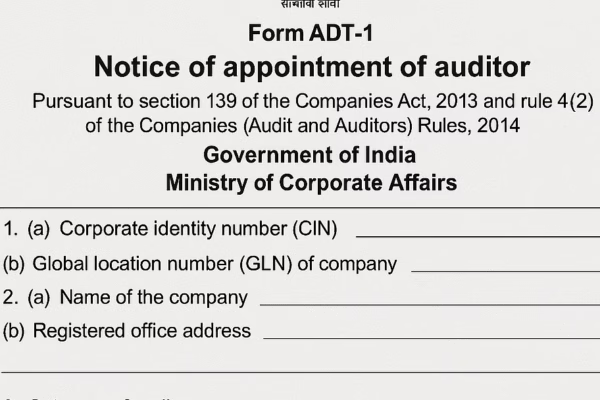

Form ADT-1

In the corporate world, statutory compliance is essential to ensure transparency and good governance. One such mandatory filing for companies in India is Form ADT-1, which is used to intimate the appointment or reappointment of an auditor to the Registrar of Companies (RoC). This article explains the purpose, due date, procedure, fees, and frequently asked […]

Form 10E

Many salaried individuals and pensioners in India often find themselves in situations where they receive arrears or advance payments due to delayed salary hikes, retrospective promotions, or pension revisions. These payments can push the taxpayer into a higher tax bracket for that year, increasing their tax liability significantly. To address this, the Income Tax Act […]