Buying or selling immovable property is a significant financial transaction and, in India, it also carries specific tax obligations. One of the most critical components of this transaction is the Tax Deducted at Source (TDS) under Section 194-IA of the Income Tax Act, 1961. Over the years, the government has introduced various amendments and notifications to tighten compliance and improve transparency. This article highlights the recent changes in TDS regulations for property transactions, providing an updated guide for buyers and sellers.

1. Background: Understanding TDS on Property Transactions

Before delving into recent changes, a quick recap of the basic provisions:

- Section 194-IA mandates the buyer immovable properties (other than agricultural land) deduct TDS at 1% of the sale consideration the property value exceeds ₹50 lakh.

- The buyer must deposit TDS with the government using Form 26QB within 30 days from end of the month in which the deduction is made.

- The buyer also issue Form 16B (TDS certificate) to the seller.

2. Key Recent Amendments and Notifications (2022–2024)

Here are the latest regulatory changes that property buyers and sellers must be aware of:

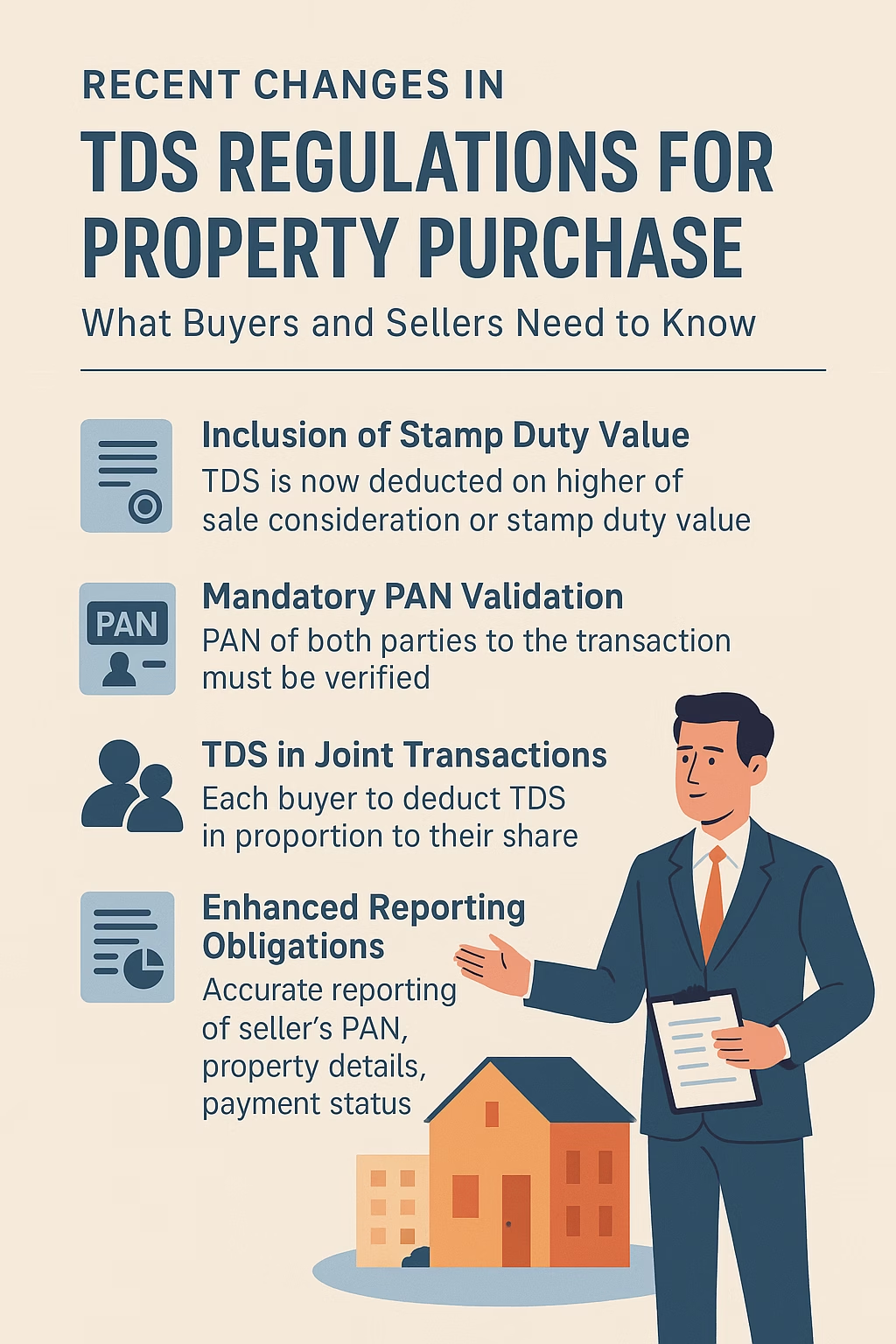

A. Inclusion of Stamp Duty Value – Finance Act, 2022

Earlier, TDS was calculated only on the actual sale consideration, not taking into account the stamp duty value of the property. However, the Finance Act, 2022 amended Section 194-IA, with effect from 1st April 2022, to include stamp duty value in the calculation.

New Rule:

TDS is to be deducted at 1% on the higher of:

- Actual sale consideration, or

- Stamp duty value of the property

Impact:

This move aims to curb undervaluation and bring uniformity with provisions under Section 50C (used for capital gains). Buyers now need to check the circle rate/stamp duty value before calculating TDS.

B. Mandatory Quoting of PAN for All Parties

The Central Board of Direct Taxes (CBDT) has reiterated the importance of quoting PAN of both buyer and seller in Form 26QB. Without valid PAN:

- The buyer cannot file Form 26QB

- TDS may be deducted at a higher rate of 20%

Recent Notification:

CBDT has validation of PANs linked to Aadhaar (under Section 139AA). From 1st July 2023, non-linked PANs are considered inoperative, impacting Form 26QB filing.

Action Point: Ensure both parties’ PANs are linked with Aadhaar before initiating the transaction.

C. Revised Timeline for Form 26QB Payment

TDS Form 26QB to be paid within 30 days from end of the month TDS was deducted. In recent updates, this timeline remains unchanged, but non-compliance now attracts stricter penalties, including:

- Late Fee under Section 234E: ₹200 per day

- Interest under Section 201(1A) 1% or 1.5% per month depending on the delay

- Prosecution and penalties for willful default

Compliance Tip: Use the TIN-NSDL portal or TRACES to file on time.

D. TDS in Joint Property Transactions – Clarified Instructions

Many property transactions involve multiple buyers or sellers. The government has clarified that:

- Each buyer must deduct TDS in their share.

- Separate Form 26QB must be filed for each combination of buyer-seller.

Example:

If 2 buyers are purchasing from 2 sellers, 4 Form 26QBs are required.

Update: TRACES portal has been modified in 2023 to auto-check these combinations and issue correct Form 16Bs.

E. Enhanced Reporting Obligations

Property buyers must ensure accurate reporting of:

- Seller’s PAN and name

- Property details including complete address and PIN

- Mode of payment and transaction dates

New Alert System:

CBDT has enabled a cross-verification system. If there’s a mismatch in reporting:

- TDS credit may not reflect for the seller

- May result in compliance notices to buyer

3. Recent Court Rulings Impacting TDS

Judicial pronouncements have further clarified TDS obligations:

- Case: CIT vs. Rajiv Kumar (2023, Delhi HC)

Held that TDS under Section 194-IA is mandatory, even if payments are staggered and property is transferred after full payment. - Case: ACIT vs. Omprakash Mehta (2024, ITAT Mumbai)

TDS must be based on stamp duty value, even if sale consideration is lower due to distress sale or discount.

4. Digital Enhancements and Ease of Compliance

New TRACES Features:

- Form 16B available within 5 days of 26QB filing

- Dashboard for real-time status of TDS deposits

- SMS/email alerts for errors or mismatches

TIN 2.0 Launched:

The new TIN 2.0 portal now allows:

- Seamless payment of TDS via net banking, debit cards, UPI

- Pre-filled details using PAN validation

- Downloadable challans and payment history

5. Implications for Buyers and Sellers

For Buyers:

- Check if stamp duty value exceeds sale price

- Deduct and pay TDS within 30 days

- File Form 26QB correctly and on time

- Generate and share Form 16B with the seller

For Sellers:

- Ensure PAN is valid and linked with Aadhaar

- Confirm TDS deduction and verify credit in Form 26AS

- Use Form 16B for tax return claims

6. Penalties for Non-Compliance

- Late filing Form 26QB: ₹200/day under Section 234E

- Interest late payment: Up to 1.5% per month

- Penalty under Section 271H: ₹10,000 to ₹1,00,000

- Disallowance of property cost if TDS not deposited (for buyers who are business entities)

Conclusion

With the increasing digitization of tax administration, TDS on property purchase has become more stringent. The inclusion of stamp duty value, mandatory PAN validation, joint transaction clarifications, and penalty structures make it vital for both buyers and sellers to stay informed. Non-compliance lead to financial penalties or legal scrutiny. It’s advisable to consult a tax professional or CA before concluding high-value property deals to ensure 100% compliance.