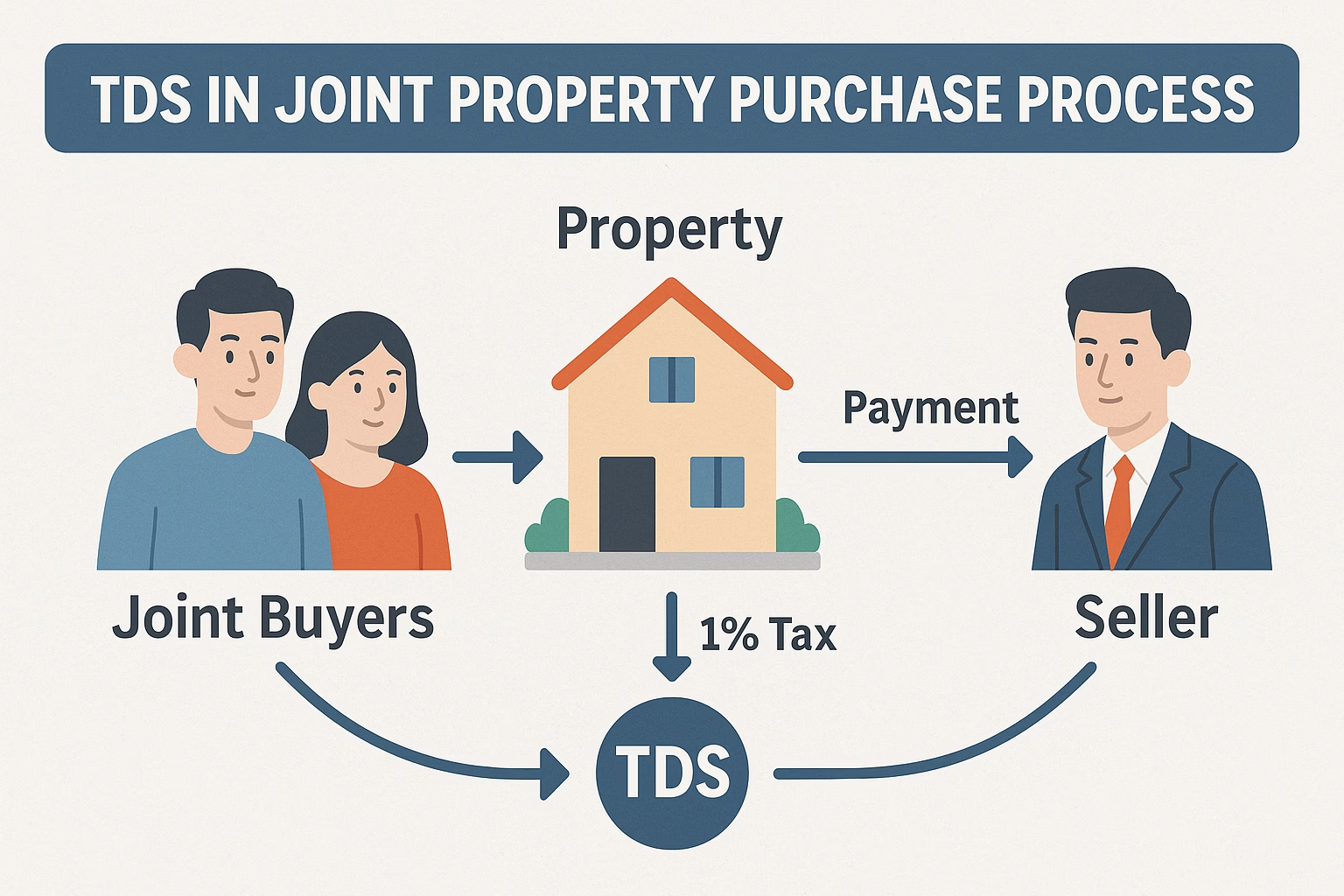

Purchasing property in India is a major financial decision, and when multiple buyers or sellers are involved, the complexity increases—especially when it comes to Tax Deducted at Source (TDS). Under Section 194-IA of the Income Tax Act, 1961, buyers are required to deduct TDS on the sale of immovable property (other than agricultural land) if the sale value exceeds ₹50 lakh. But how does this provision apply when there is joint ownership?

This article breaks down how TDS is handled in a joint property transaction—whether you’re buying with someone else or dealing with multiple sellers.

-

Overview of TDS on Property Transactions

As per Section 194-IA:

- 1% TDS must be deducted on the total sale consideration of the property (not on individual shares).

- The buyer must deduct TDS before making payment to the seller and deposit it with the government using Form 26QB.

- The TDS is applicable when the sale value is more than ₹50 lakh.

-

When There Are Multiple Buyers

When two or more individuals purchase a property together, each buyer is considered independently for TDS compliance. Here’s what you need to know:

Scenario: Joint Buyers, Property Value > ₹50 Lakh

If the property value exceeds ₹50 lakh—even if individual shares are below ₹50 lakh—TDS must still be deducted.

Example:

- Property Value: ₹80 lakh

- Buyer 1 share: ₹40 lakh

- Buyer 2 share: ₹40 lakh

TDS of ₹80,000 (1% of ₹80 lakh) is to be deducted. It does not matter that each buyer’s share is under ₹50 lakh.

TDS Filing Requirement:

- Each buyer must file Form 26QB separately for each seller.

- So, in case of 2 buyers and 1 seller, 2 Form 26QB filings are required.

- In case of 2 buyers and 2 sellers, 4 Form 26QB filings are required.

-

When There Are Multiple Sellers

Multiple sellers typically mean the property is co-owned. Even then, TDS rules apply on the total transaction value, not on the seller’s individual share.

Scenario: Joint Sellers, Sale Value > ₹50 Lakh

If a jointly owned property is sold for more than ₹50 lakh, TDS must be deducted on the entire sale price, and it is proportionally credited to each seller based on their ownership.

Example:

- Property sold: ₹1 crore

- Seller A owns 60%, Seller B owns 40%

- Buyer must deduct ₹1,00,000 as TDS (1% of ₹1 crore)

- Buyer files Form 26QB twice—once for Seller A, once for Seller B

Each seller will get a TDS credit in their PAN as per their share.

-

Compliance Steps for Joint Transactions

- TAN Not Required: Under Section 194-IA, buyers need not obtain a Tax Deduction Account Number (TAN). PAN is sufficient.

- PAN of All Parties: Buyers must collect PAN of each seller and co-buyer and verify it on the Income Tax portal.

- File Form 26QB Separately: For each combination of buyer and seller, a separate Form 26QB must be submitted.

- TDS Payment: Payment should be made within 30 days from the end of the month in which the deduction is made.

- Form 16B: After TDS payment, buyers must download Form 16B (TDS certificate) from TRACES and provide it to the seller(s).

-

Consequences of Non-Compliance

- Interest: 1% per month for non-deduction, 1.5% per month for non-payment after deduction.

- Penalty: ₹200 per day for late filing of Form 26QB, up to the TDS amount.

- Disallowance: Buyer may not be able to claim tax deductions unless TDS compliance is met.

-

Common Mistakes and How to Avoid Them

|

-

Tips for Smooth Compliance

- Consult a CA if multiple parties are involved.

- Keep a clear agreement detailing the share of each party.

- Maintain all transaction records, PAN copies, and bank details.

- Download and retain Form 16B as proof of TDS compliance.

Conclusion

Handling TDS in a joint property transaction requires attention to detail and strict adherence to procedural steps. Whether you are buying with a spouse, sibling, or business partner—or selling jointly—each buyer must understand their responsibility in deducting and depositing TDS properly.