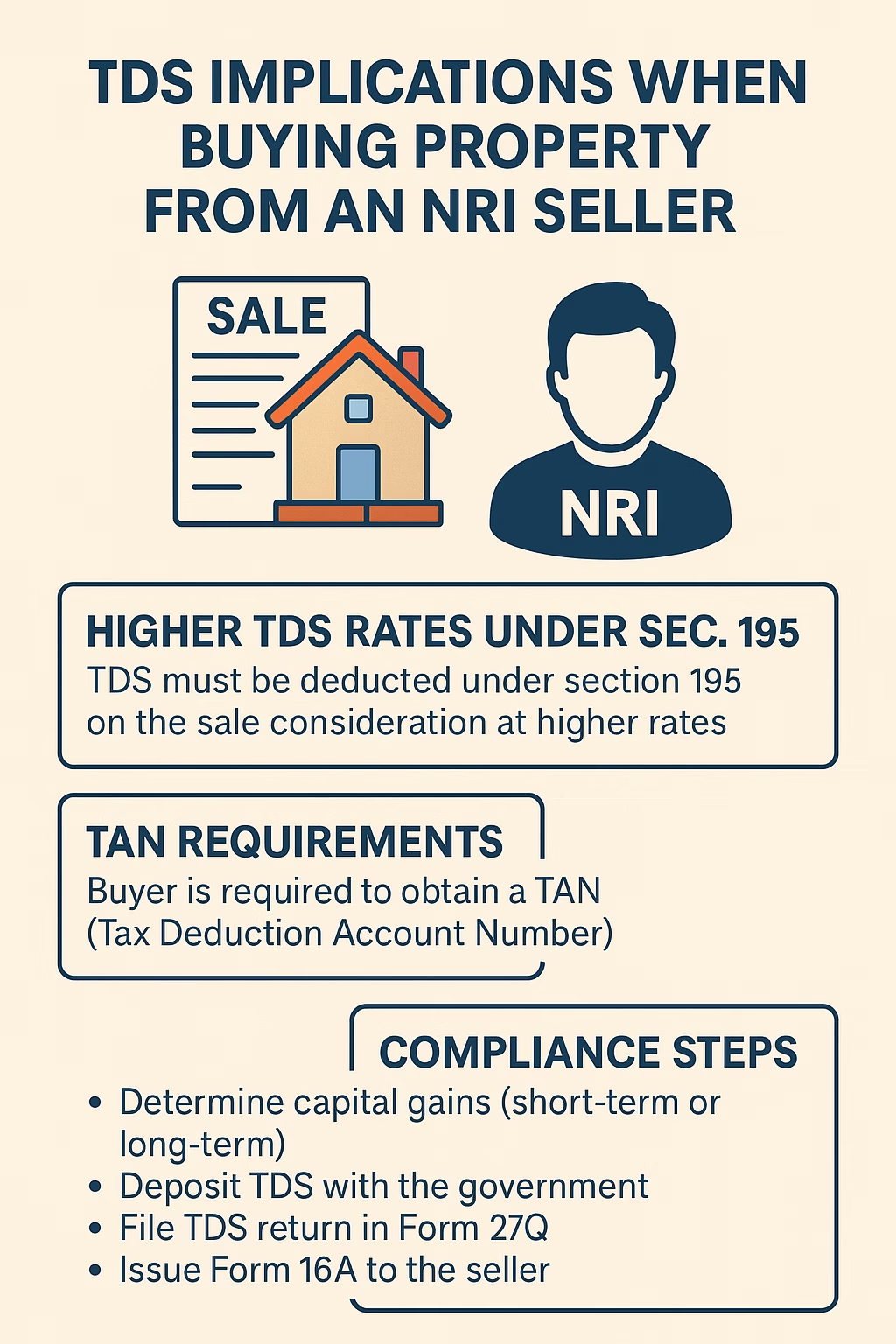

(Understanding Section 195, Higher TDS Rates, TAN Requirements & Compliance Steps)

Buying property in India is a significant financial decision, and when the seller is a Non-Resident Indian (NRI), the transaction becomes even more complex from a tax compliance perspective. One of the most crucial aspects in such a scenario is Tax Deducted at Source (TDS) under Section 195 of the Income Tax Act, 1961. This section imposes a duty on the buyer to deduct and deposit tax before making payment to the NRI seller.

This article provides a detailed explanation of the TDS implications when purchasing property from an NRI, the applicable tax rates, TAN requirements, and the step-by-step compliance process.

Who is Considered an NRI for Tax Purposes?

Before diving into the tax details, it’s essential to identify who qualifies as an NRI. According to Indian tax laws, a person is considered an NRI if:

- They reside outside India more than 182 days during financial year.

- They do not meet the criteria for “resident” under Section 6 of the Income Tax Act.

Seller is confirmed an NRI the buyer becomes responsible for ensuring TDS compliance under Section 195.

Section 195 – What Does It Say?

Section 195 mandates that any person making a payment to a non-resident that is chargeable to tax in India must deduct tax at source. In context of property transactions, the buyer is responsible for:

- Deducting TDS before making the payment to NRI seller.

- Depositing the TDS amount with the government.

- Filing the appropriate returns and issuing TDS certificates.

TDS Rates Applicable Under Section 195

Unlike property purchases from resident Indians (where Section 194-IA applies and the TDS rate is 1% if the sale value exceeds ₹50 lakh), transactions with NRIs attract significantly higher TDS rates under Section 195. These rates depend are the property sale results in short-term or long-term capital gains.

- Long-Term Capital Gains (LTCG):

- Applicable the property is held by NRI more than 24 months.

- TDS Rate: 20%

- Add: Surcharge and Health & Education Cess (HEC)

- Effective Rate: Can go up to 23.92% or more based on the income slab and total consideration.

- Short-Term Capital Gains (STCG):

- Applicable property is held 24 months or less.

- TDS Rate: According to income tax slab rates applicable to NRIs

- ₹2.5 lakh – ₹5 lakh: 5%

- ₹5 lakh – ₹10 lakh: 20%

- Above ₹10 lakh: 30%

- Plus surcharge and cess

Note: The TDS is generally deducted on the entire sale consideration, not just the capital gain, unless the seller obtains a certificate for lower/nil deduction.

Obtaining a TAN – Mandatory for the Buyer

One of the primary requirements when buying from an NRI is that the buyer must obtain a TAN (Tax Deduction and Collection Account Number).

Steps to Obtain TAN:

- Visit the TIN NSDL portal.

- Select Form 49B for TAN application.

- Fill in details such as buyer’s name, address, PAN, etc.

- Submit the form online pay the applicable fee.

- On successful submission, a 14-digit TAN is issued.

Without a TAN, the buyer cannot deduct TDS or file returns using Form 27Q, which is mandatory under Section 195.

TDS Deduction and Payment – Procedure

Step-by-Step guide TDS deduction and payment when buying property from an NRI:

Step 1: Calculate TDS

- Determine the applicability of LTCG or STCG.

- Calculate TDS on total sale consideration (not just profit), unless a lower deduction certificate is available.

- Include surcharge and cess.

Step 2: Deduct TDS

- TDS should be deducted at the time of payment or credit, is earlier.

- If payment is made in instalments, TDS must be deducted on each instalment.

Step 3: Deposit TDS

- Use Challan No./ITNS 281 to deposit TDS online via the TIN NSDL website.

- Payment must be made using the buyer’s TAN and PAN of the NRI seller.

Step 4: File TDS Return – Form 27Q

- The buyer file quarterly TDS return in Form 27Q (for NRI payments).

- Due Dates:

- April–June: 31st July

- July–September: 31st October

- October–December: 31st January

- January–March: 31st May

Step 5: Issue Form 16A to Seller

- After filing Form 27Q, download Form 16A (TDS Certificate) from the TRACES website.

- Provide a copy to the NRI seller as proof of TDS deducted and deposited.

What are Lower or Nil TDS Certificate (Form 13)?

To avoid unnecessary blockage of funds, the NRI seller can apply for a Lower/Nil TDS Certificate by filing Form 13 with the Income Tax Department. The certificate is issued under Section 197.

- The seller must submit property documents, purchase price, estimated capital gain, and related documents.

- If granted, the buyer will deduct TDS at the reduced rate mentioned in the certificate.

- This certificate must be obtained before the transaction.

Consequences of Non-Compliance

Failure to follow the prescribed steps under Section 195 can have serious consequences:

- Interest and Penalty:

- Interest under Section 201(1A):

- 1% per month for late deduction

- 1.5% per month for late payment

- Penalty under Section 271 C: Equal the TDS amount not deducted.

- Assessee-in-Default:

- The buyer may be treated as an “assessee-in-default” and held liable for tax payable by the seller.

Best Practices for Buyers

- Verify NRI Status: For passport and overseas address proof.

- Collect PAN: Both buyer and seller PAN are mandatory.

- Hire a Tax Expert: Engage a Chartered Accountant to compute capital gains and handle Form 13 if needed.

- Document Everything: Keep a copy of the sale deed, payment receipts, TDS challans, Form 16A, and Form 27Q.

- Coordinate with Loan Provider: Ensure TDS is deducted before each loan disbursement to the NRI seller.

Conclusion

Purchasing property from an NRI demands diligent compliance with Indian tax laws, especially TDS provisions under Section 195. The onus is on the buyer to deduct, deposit, and report TDS properly. Higher deduction rates, TAN registration, quarterly return filings, and careful calculation of capital gains are all critical components of this process.