Many of us are interested in doing charity by making an organization, but didn’t know how to do it. The legal way to do it through a trust. In this article let us understand the whole process of how to create a trust and its benefit. A trust is a legal arrangement in which a person (settlor) transfers assets to another person or entity (trustee) for the benefit of specified individuals (beneficiaries) or for a charitable purpose. Trusts are commonly used for estate planning, tax benefits, and charitable activities. In India, trusts are governed by the Indian Trusts Act, 1882 and are subject to taxation under the Income Tax Act, 1961.

What is a Trust?

A trust is a legal arrangement where one person (the Settlor) transfers property or assets to another person or entity (the Trustee) to hold and manage for the benefit of a third party (the Beneficiary).

Trusts are commonly used for estate planning, asset protection, charitable activities, and tax benefits.

Example: “Mr. Arvind Mehta creates ‘The Mehta Family Trust’ to provide financial support to his children. Rohan and Ananya, with his wife and brother as trustees managing the assets for their benefit.

Types of Trusts

Parties in a Trust

Example of a Trust

Example 1: Private Trust for Family

Mr. A, a wealthy businessman, wants to ensure his children receive financial security after his death. He creates a Private Trust by transferring ₹10 crore into it and appoints a trustee (his lawyer). The trust specifies that his children will receive ₹50,000 per month until they turn 25, after which they will receive their full inheritance.

- Settlor: Mr. A

- Trustee: Lawyer managing the trust

- Beneficiaries: His children

- Trust Property: ₹10 crore

Example 2: Charitable Trust for Education

XYZ Foundation is a Public Charitable Trust established to provide scholarships to underprivileged students. Donations received by the trust are used to fund student education. Since it is a charitable trust, it is exempt from income tax under Section 12A of the Income Tax Act.

- Settlor: A group of charitable individuals who created the trust for social welfare.

- Trustee: Board of trustees managing funds

- Beneficiaries: Underprivileged students

- Trust Property: Donations and funds for scholarships

Taxation of Trusts in India

The taxation of trusts in India depends on whether the trust is a charitable/religious trust or a private trust which given below:

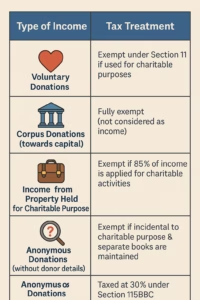

1. Taxation of Charitable & Religious Trusts

Charitable /religious trusts can claim tax exemptions under Section 11 & 12 of the Income Tax Act, 1961, provided they meet certain conditions.

A. Conditions for Tax Exemption

- Registration under Section 12A – The trust must be registered with the Income Tax Department.

- Utilization of 85% of Income – At least 85% of the trust’s income must be used for charitable or religious purposes in the same financial year.

- Accumulation of Income – If the trust cannot spend 85% of its income, it can accumulate it for up to 5 years, but it must be specified in Form 10.

- Business Income Restrictions – If a trust runs a business, it must be incidental to its objectives, and separate books of accounts must be maintained

B. Tax Treatment

| Type of Income | Tax Treatment |

| Voluntary Donations | Exempt under Section 11 if used for charitable purposes |

| Corpus Donations (towards capital) | Fully exempt (not considered as income) |

| Income from Property Held for Charitable Purposes | Exempt if 85% of income is applied for charitable activities |

| Business Income | Exempt if incidental to charitable purpose & separate books are maintained |

| Anonymous Donations (without donor details) | Taxed at 30% under Section 115BBC |

C. Tax Rates for charitable/religious Trusts

- If the trust meets all conditions, income is exempt from tax.

- If conditions are not met, the trust is taxed at 30% (maximum marginal rate).

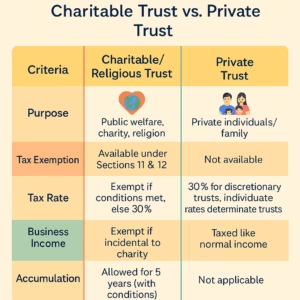

2. Taxation of Private Trusts

Private trusts are created for the benefit of specific individuals, such as family members. Their taxation depends on whether the beneficiaries are determinate (fixed) or indeterminate (unknown share).

- Determinate Trust (Beneficiaries have a fixed share)

- Income is taxed in the hands of beneficiaries according to their share.

- Example: If a private trust earns ₹10 lakh and has two beneficiaries with a 50-50 share, each beneficiary is taxed on ₹5 lakh as per their individual tax slab.

- Indeterminate Trust (Beneficiaries’ share is not fixed)

- Income is taxed in the hands of the trust at the maximum marginal rate of 30%.

- Example: If a private trust earns ₹10 lakh and the beneficiaries are not clearly defined, the trust is taxed at 30% on the full amount.

- Business Income of Private Trust

- If the trust earns income from a business, it is taxed like a normal business entity under regular tax slabs.

Comparable Chart of Charitable Trust Vs Private Trust

Steps to Create a Trust in India

Step 1: Draft a Trust Deed

A trust deed is the fundamental legal document required to create a trust. It should include:

- Name & Address of Settlor, Trustee(s), and Beneficiary(ies)

- Purpose of the Trust

- Assets held by the Trust

- Duties & Powers of Trustees

- Management & Governance Rules

- Dissolution Clause (if any)

- 📌 Reference: Trust Deeds can be drafted with the help of a Chartered Accountants.

Step 2: Register the Trust

- For Private Trust – Not mandatory but can be registered under the Indian Registration Act, 1908.

- For Public/Charitable Trust – Registration with the Charity Commissioner is required.

Where to Apply?

- Uttar Pradesh (Greater Noida, Ghaziabad, etc.): https://uprfsc.gov.in/

- Delhi: https://registrarofsocieties.delhigovt.nic.in/

- Other States: Check respective State Charity Commission websites.

Step 3: Obtain PAN & Bank Account

- Apply for a PAN (Permanent Account Number) for the trust.

- Open a separate bank account in the trust’s name.

Where to Apply?

- NSDL (Protean e-Gov): https://www.onlineservices.nsdl.com

- UTIITSL: https://www.pan.utiitsl.com

Step 4: Apply for Section 12A & 80G Registration (If Charitable Trust)

- Section 12A – For exemption on income of the trust.

- Section 80G – For donors to claim tax deductions on donations made to the trust

Where to Apply?

- Income Tax Department Portal: https://www.incometaxindia.gov.in.

Step 5: Annual Compliance & Tax Filings

- File Income Tax Return (ITR-7) annually.

- Maintain proper books of accounts.

- Get accounts audited under Section 12A if total receipts exceed ₹2.5 lakh.

Frequently Asked Questions (FAQ) on Trust Registration in Uttar Pradesh

- What is a Trust?

A trust is a legal entity created to manage assets or funds for a specific purpose, such as charity, education, religion, or public welfare. It is governed by the Indian Trusts Act, 1882 (for private trusts) and the Charitable & Religious Trusts Act, 1920 (for public trusts).

- Who are the main parties involved in a Trust?

A trust consists of the following parties:

- Settlor – The person who creates the trust and transfers assets.

- Trustees – Individuals responsible for managing the trust.

- Beneficiaries – The individuals or groups who benefit from the trust.

- Where can I register a Trust in Uttar Pradesh?

In Uttar Pradesh, trusts are registered under the Registrar of Societies, Firms & Chits (not a Charity Commissioner).

📌 Official website: https://uprfsc.gov.in/

📍 For Greater Noida applicants: The office is located in Meerut or Lucknow.

- What documents are required for Trust registration?

✔ Trust Deed (on ₹500 or ₹1000 stamp paper)

✔ PAN & Aadhaar cards of all trustees

✔ Trust Address Proof (Electricity Bill, Rent Agreement)

✔ NOC (if property is included)

✔ Affidavit from Trustees

✔ Trust PAN Card (Apply after registration)

- How much time does it take to register a Trust?

The registration process usually takes 30 to 90 days, depending on document verification and processing speed.

- Can a Trust be registered online in Uttar Pradesh?

Yes, you can apply online through the UP Registrar of Societies Portal:

👉 https://uprfsc.gov.in/

- How many trustees are required to form a Trust?

There is no minimum or maximum limit, but generally, at least two or more trustees are recommended.

- What are the benefits of registering a Trust?

✔ Legal recognition for charitable and social activities

✔ Tax exemptions under Section 12A & 80G

✔ Eligible to receive government grants and donations

✔ Protects assets and funds for the intended beneficiaries

- What is 12A and 80G registration?

- 12A Registration – Exempts the trust from paying income tax.

- 80G Registration – Allows donors to claim tax deductions for donations.

You must apply separately through the Income Tax Department.

- How to check the status of my Trust registration application?

- Go to https://uprfsc.gov.in/

- Click on “Application Status”

- Enter your application number and check the progress.

- Can I register a religious trust, like a temple trust?

Yes, religious trusts (e.g., temple trusts, mosque trusts) can be registered under the Charitable & Religious Trusts Act, 1920.

- What is the difference between a Trust and a Society?

| Feature | Trust | Society |

| Governing Law | Indian Trusts Act, 1882 | Societies Registration Act, 1860 |

| Minimum Members | 2+ Trustees | 7+ Members |

| Management | Trustees | Governing Body |

| Registration Authority | Registrar of Societies | Registrar of Societies |

- Is a Trust required to file annual returns?

Yes, a registered Trust must:

✅ File Income Tax Returns (ITR) every year.

✅ Submit Audit Reports (if annual income exceeds ₹2.5 lakh).

✅ Renew 12A & 80G approvals (if applicable)

- Can a Trust own property?

Yes, a Trust can buy, sell, and manage property in its name. However, property cannot be distributed among trustees for personal gain.

- What is the fee for Trust registration in Uttar Pradesh?

The registration fee varies from ₹500 to ₹5000, depending on the trust type.

- Can I modify the Trust Deed after registration?

Yes, amendments can be made, but they require approval from the Registrar and a court order in some cases.

- How to contact the Registrar of Societies in Ghaziabad?

visit: https://uprfsc.gov.in/Contactus.aspx